A Component of Tucker Administrators’ Employee Benefit Risk Management Program

|

Self-funding often referred to as self-insurance, can have many advantages for both private sector and public employers, including more input in health plan design and better control over rising costs. Because of these advantages, the majority of US group health plans are self-funded. If you are not familiar with the self-funding model and would like to learn more, click here for information on how self-funding works, and real-life employer success stories. |

What is self-funding?

A self-funded health plan is sponsored and designed by the employer. The employer does not purchase traditional “insurance”, but pays for actual claims through a reserve fund established specifically for this purpose. Stop loss insurance is purchased to protect the company against high dollar claims. It allows a plan to set in advance the maximum loss levels it is willing to sustain on any specific situation or on the aggregate of claims on the whole group. A Third-Party Administrator (TPA) is usually hired to administer the plan. Administering the plan includes to adjudicate and pay the claims, provide COBRA/ HIPAA administration, ensure compliance with the current federal regulatory requirements, research and select stop loss insurance, prepare the Summary Plan Description, and to generate detailed monthly reports so the employer can see each and every health plan expenditure.

Why Use Tucker Administrators for a self-funded plan?

- We have experience-we have been in business since 1976

- We have the expertise needed for appropriate stop loss placement

- We have access to several Pharmacy Benefit Managers for drug cost containment

- We have access to top quality stop loss carriers with A- or better financial rating

- We have the technology for claims detail and other reporting tools

- We offer other cost containment tools such as population/disease management services, wellness plans and on-site clinics

- We offer compliance assistance, including the Affordable Care Act (ACA)

- And most of all, we offer superior service

Is self-funding risky for small employers?

Many people think self-funding is appropriate only for the larger employer with over 100 employees. However, since health plan expenses now ranks as the largest employee expense, smaller employers are now seeking self-funded health plans as a way to reduce costs.

Stop loss insurance is purchased to protect the company against high dollar claims. It allows a plan to set in advance the maximum loss levels it is willing to sustain on any specific situation or on the aggregate of claims on the whole group.

What types of benefits are self-funded?

Usually the group health plan is the focus of a self-funded program. Other health benefits are often included, such as dental, vision, prescription drugs, and short-term disability. Certain high loss, low frequency coverages, such as life insurance, accidental death and dismemberment, and long-term disability are generally not suitable for self-funding.

What Are the Advantages To Self-Funding a Health Plan?

Employer Investment:

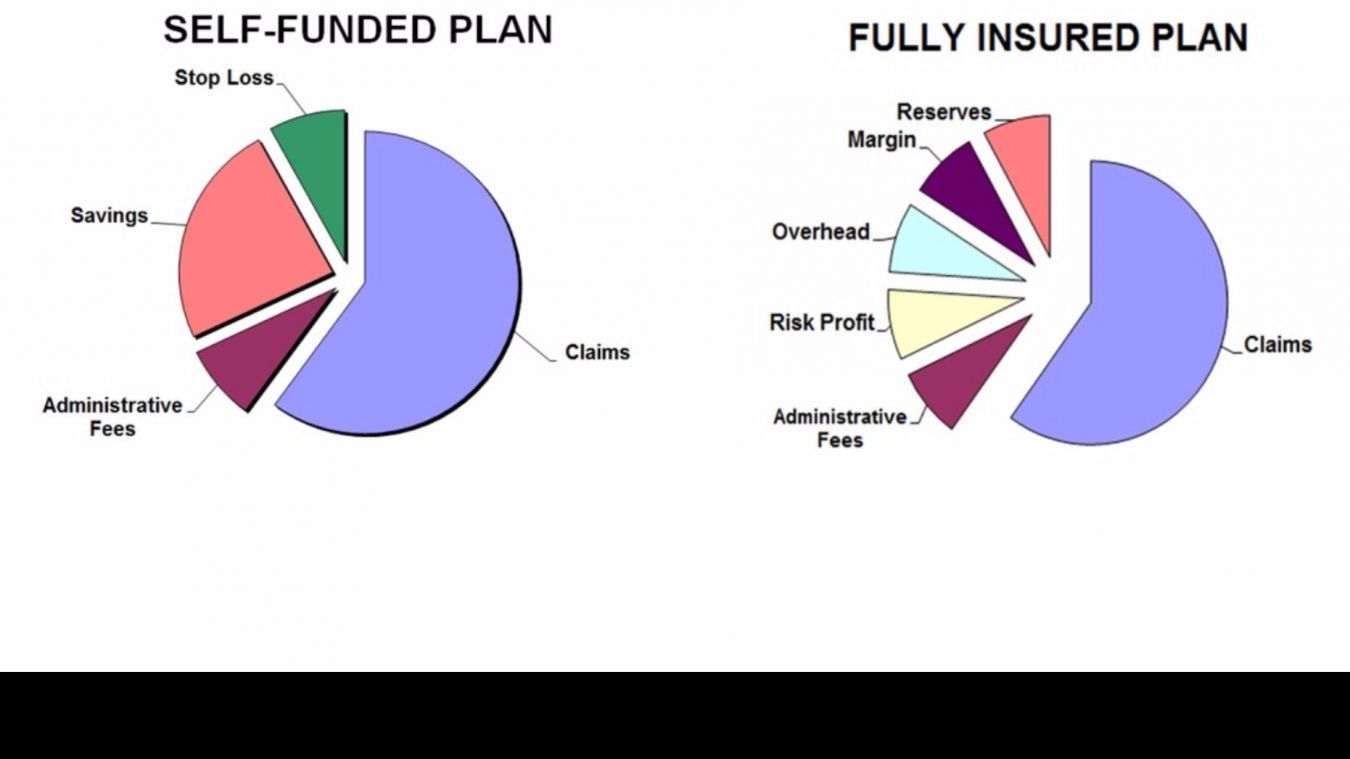

Employers invest millions of dollars each year in insured employee benefit plans. As the cost of providing medical insurance increases, employers are looking at funding alternatives for their health and welfare plans. Many employers are disappointed with their fully-insured plans because:

-

-

- They are limited to off-the-shelf plans.

- Effective cost containment programs are not always available.

- Fully insured plans tend to consume employee compensation dollars that can be better spent to curb employee turnover and to attract new, qualified employees.

- Self-funded plans are regulated under ERISA, that preempts individual state mandates for health insurance and allows an employer to offer a standardized health plan across state jurisdictions.

-

More Financial Control:

Under a self-funded plan, it is usually possible for an employer to reduce operating costs significantly and maintain control of reserves usually held by insurance companies. The reserves should be held in a trust, producing tax-exempt interest and thereby reducing the cost of providing employee benefits. Reserves can also be held in an interest-bearing bank trust account.

Financial Protection: In order to provide an extra measure of financial protection against catastrophic claims, most employers purchase Stop Loss insurance coverage. This protects the plan from large individual claims and from an excessive amount of total claims.

Elimination of most premium tax:

In most states, there is no premium tax for self-funded claim funds. This produces an immediate savings equal to the amount of the premium tax, approximately 2% to 3% of the fully-insured premium.

Lower cost of operation:

Employers frequently find that administrative costs for a self-funded program through Tucker Administrators are lower than those charged by their previous insurance carrier.

Carrier profit margin and risk charge eliminated:

The profit margin and risk charges of an insurance carrier are eliminated for the bulk of the plan. This translates into direct savings for the client.